Money talks, advisors need to listen

Staying competitive in a changing era

Wealth management firms are using 2024 to redefine the traditional financial advisor role and are investing in technology conducive for a “hybrid” relationship. as clients threaten to take their assets elsewhere.

“Clients today are more willing to switch advisors if they’re not starting to actually get the relationship results that they’re looking for,” says Donna Bristow, Chief Product Officer for Wealth Management at Broadridge. Clients increasingly favor close relationships with advisors that serve as life coaches over pure portfolio managers. Throughout the next year, firms will want to arm their advisors with tools and technologies that will help them build deeper, more holistic, and personalized relationships with clients than before.

“Wealth management firms no longer compete on a one- or two-sizes-fits-all model,” Bristow says. “There is a new emphasis on improving client retention, client growth, and personalization, which requires redefining the financial advisor’s role to better fit changing client expectations.”

Education becomes a differentiator

Clients want more personalized insights & expect deeper collaboration based on their goals and plans, Bristow says. Younger clients in particular want advice and validation when making large financial decisions, she adds.

“Advisors that really build a strong relationship with their clients,” Bristow says, “can help them manage and budget based on their goals and plans. They’ll provide insights and advice across the client lifecycle of events, so they’re actually becoming more like life coaches.” This support goes beyond the traditional management of retirement funds and creates more sustained client loyalty.

“Firms want to provide their advisors with seamless integration from prospecting, all the way through to client onboarding, and actually servicing the account,” says Bristow. “This is a fully integrated process that creates valuable efficiencies and benefits for investors, clients, advisors, and operational professionals alike.”

Donna Bristow, Chief Product Officer, Broadridge

Advisors go beyond money management

As clients seek a more holistic advisor relationship, firms are also encouraging advisors to continue offering products and services beyond traditional money management. These can include mortgages and loan products, or offering tax managed services.

Wealth management firms will want to roll out various tools and technologies to aid advisors that are taking on more tasks and responsibilities to satisfy clients.

“How the advisor can leverage home office support will vary from firm to firm,” Bristow says. “They may use home office support to assist their client, extending their ability to meet the client needs. Or they might use tools in more timely and automated ways. Ultimately, customer service excellence is the goal; AI can assist in this by providing insights or performing administrative tasks only needing validation or review.”

With advisors retiring and a generational wealth transfer increasing advisor demand, the wealth management industry will require each advisor to take on more clients, manage larger books, and make the most of their time. Automated tools are key to boosting efficiency, Bristow says.

“Firms want to provide their advisors with seamless integration from prospecting, all the way through client onboarding, to actually servicing the account,” says Bristow. “It’s a fully integrated process that creates efficiencies for investors, clients, advisors, and operational professionals.”

Embracing digital communications

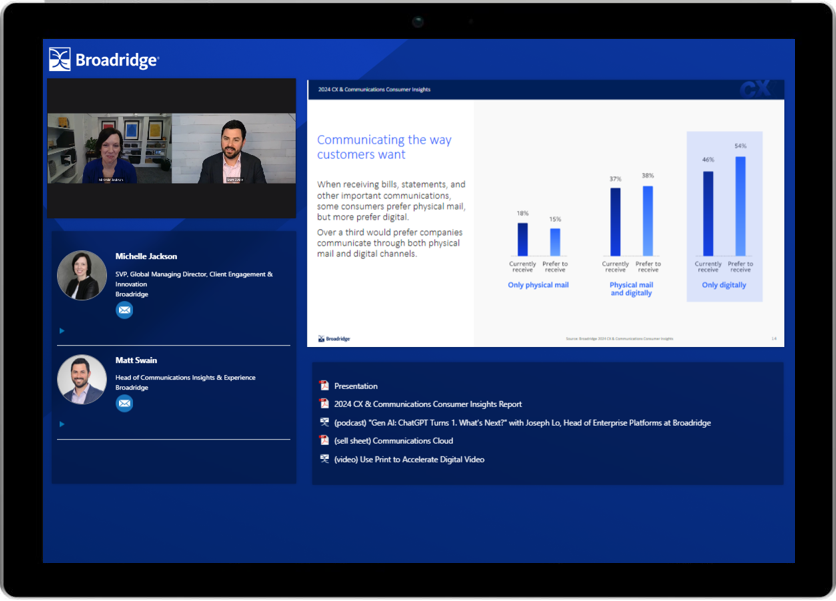

Clients have become more comfortable with virtual meetings and tools, and they now expect advisors to be comfortable communicating online and in-person.1These clients desire frequent communication and information fed to them through various channels in a hybrid model. Investors want weekly communication from advisors, but just 26% of advisors are meeting this expectation, according to Broadridge’s research.

“Everyone is on their computer if they weren’t before,” Bristow said. “The ability to collaborate with advisors, based on the client’s choice of communication, is now the norm.” Clients now expect advisors to send information through their preferred communication channel, which can include cell phone texts, emails, a smartphone application or traditional paper mail.

“Regardless of age and generation, everyone has their own preferences on how they want to be engaged by their advisor.”

The survey showed that clients want advisors to communicate on a weekly cadence, and 74% of advisors are not meeting that frequency. Additionally, investors want advisors to communicate on a weekly cadence, yet only 26% of advisors are doing so. Investing in emergency technology can make this easier for advisors who are already expected to do more for clients with less time.

Tech investments will continue

Investing in AI to make personalized client predictions or more effectively use data in decision-making can save advisors time and allow for deeper conversations when making various financial decisions.

A number of firms started making technology investments during the second half of 2023 and that’s likely to continue through 2024. For example, Morgan Stanley rolled out a generative AI chatbot last fall to help financial advisors in its wealth management division.1 Raymond James Financial announced in an October 2023 press release that it would integrate a tax management technology from 55ip, a financial technology company owned by J.P. Morgan, across its managed account platform to help with tax-loss harvesting.2 In December, Edward Jones announced in a press release that it made its MoneyGuide Elite financial planning software available to all U.S. branch teams during the second half of 2023.3 Broadridge has embraced GenAI both internally and externally, creating tools that help traders understand the bond market, operations professionals find issues within their systems, and even internal tools to help associates deepen their knowledge of these emerging tools.

Source:Broadridge 2024 Financial Advisor Marketing Trends Report

Only 8% of advisors currently use AI in their marketing efforts, however, those who do tend to be younger and more growth-focused, but this expected to change. Thirty-five percent of advisors plan to use AI in the future and those who do can expect major benefits in a tech-centric landscape.

Firms that automate tedious processes unlock additional time for advisors to spend on client relationships and bring overall efficiencies to the operation, Bristow said. “That connection between the advisor and home office operations is going to become even more important in 2024.”

The industry’s future has already started

The wealth management landscape is undergoing a significant shift, driven by client demand for personalization, tech-enabled experiences, and holistic financial guidance. To thrive in this evolving environment, wealth firms must prioritize investing in technologies that empower advisors to build deeper client relationships, automate administrative tasks, and communicate effectively across various channels. By embracing these changes, firms can position themselves to win the future of wealth management.

As the wealth management industry undergoes major changes in response to client demands, it is crucial for firms and advisors to embrace technology and new strategies to stay competitive. To drive future success, wealth management firms must invest in tools and technologies that enhance client relationships, provide personalized advice, and streamline operations. By prioritizing these changes, firms can position themselves for growth and success in the rapidly evolving wealth management landscape. Take action now to adapt and thrive in this new era of wealth management.

Work with a trusted,

award-winning partner

WINNER 2023

Lending Transformation & Overall Winner

IDC FinTech Real Results

LEADER 2023

Digital Experience Platforms

Everest Group PEAK Matrix

WINNER 2023

Best Overall US WealthTech Provider

WealthTechAmericas

WINNER 2023

Best Innovative Client Solution (Canada)

WealthTechAmericas

LEADER 2022

Credit Lending Operations

Chartis RiskTech Quadrant

LEADER 2022

Wealth Management Products

Everest Group PEAK Matrix

Connect with our experts about the future of wealth management

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |